Tax Court of Schleswig-Holstein: Carried interest from an asset-administrating US fund is taxable in Germany

The Tax Court of Schleswig-Holstein ruled in its judgement of 8 October 2024 (docket-no: 3 K 37/22) that the carried interest of a fund manager resident in Germany from an asset-administrating US fund is taxable in Germany because the carried interest does not constitute tax-exempt business profits within the meaning of Art. 7 (1) of the Double Taxation Treaty between Federal Republic of Germany and the United States of America. This is the first judgement on this issue. The view of the Tax Court of Schleswig-Holstein can result in a double taxation if the carried interest is also taxed abroad. In such cases, it must be analysed whether foreign tax can be credited or deducted in Germany. However, the judgement has a positive impact on fund managers of German asset-administrating funds domiciled abroad.

I Background

Recent case law has fortunately brought some clarity to the decades-long dispute over the tax treatment of carried interest. In two landmark rulings on commercial partnership funds (see Federal Fiscal Court (“BFH”), judgement of 11 December 2018, docket-no. VIII R 11/16 and our (German) article on this topic) and on asset-administrating partnership funds (see Federal Fiscal Court, judgement of 16 April 2024, docket-no. VIII R 3/21 and our (German) article on this topic), the BFH ruled in favour of fund managers that carried interest represents a profit share from the fund that may be taxed at a preferential rate and not a fully taxable service fee.

However, the tax treatment of carried interest in cross-border cases has not yet been conclusively clarified to a large extent. The Tax Court of Schleswig-Holstein has now had the first opportunity to decide on the taxation of carried interest in an outbound situation (i.e. fund manager resident in Germany earning carried interest from a U.S. fund) under the relevant Double Taxation Treaty between Federal Republic of Germany and the United States of America (“Treaty“).

II Facts

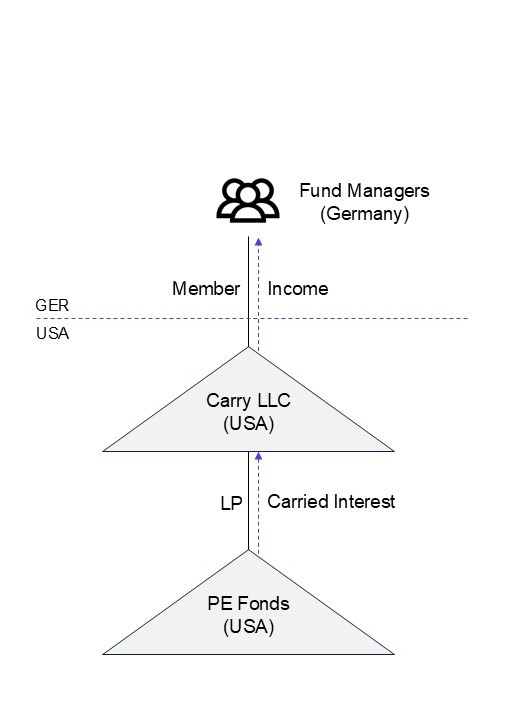

The plaintiff, a US-American limited liability company with its registered office and management in the USA, was set-up as a carry vehicle in two US-American and one German funds. The business purpose of the funds was essentially the acquisition, holding and sale of shares in corporations. Both the plaintiff and the funds did indisputably qualify as partnerships from a German tax perspective. Only natural persons were involved in the plaintiff as fund managers, some of whom were resident in Germany for tax purposes.

From 2011 onwards, the funds realised profits from the sale of portfolio companies for the first time, which resulted in payments of carried interest to the plaintiff. The German fund managers participated in the carried interest in accordance with the rules on profit distribution at the level of the plaintiff.

The facts of the case can be simplified and summarised as follows:

III Legal views of plaintiff and tax office

The plaintiff declared the carried interest in the tax return as income from self-employment within the terms of § 18 (1) sentence 1 no. 4 of the Income Tax Act (“EStG”). To the extent the carried interest had already been taxed in the USA, the plaintiff treated the carried interest as tax-free foreign business profits in accordance with Art. 7 (1) in conjunction with Art. 23 (3) lit. a of the Treaty. To the extent the carried interest had not been subject to prior tax in the USA, the plaintiff declared taxable income in Germany, as the so-called switch-over clause pursuant to Art. 23 (4) lit. b of the Treaty was applicable.

In contrast, the tax office treated the carried interest as fully taxable on the grounds that the carried interest could not be classified as business profits under Art. 7 (1) of the Treaty. This would only be the case if the profits originated from an entrepreneurial, i.e. a commercial, activity. In addition, a US permanent establishment within the meaning of Art. 5 of the Treaty would be required to exempt these profits. In the underlying case, according to the tax office both elements were not given, since the plaintiff is indisputably active only in administering its assets. Rather, the catch-all provision of Art. 21 of the Treaty (i.e. other income), which assigns the right of taxation to Germany, should be relevant. Further, in order to avoid possible double taxation, a tax credit (§ 34c (1) EStG) or a tax deduction (§ 34c (2) EStG) should generally permissible (not relevant in the case in dispute, as the plaintiff had waived this).

IV Judgement of Tax Court of Schleswig-Holstein

The Tax Court of Schleswig-Holstein dismissed the claim and ruled that the carried interest may be taxed in Germany. It followed the view of the tax office to the extent that the carried interest does not qualify as business profit within the terms of Art. 7 (1) of the Treaty. Therefore, the court also ruled-out a tax-exemption under the Treaty in Germany. Referring to recent BFH case law (see I above), the Tax Court of Schleswig-Holstein stated that the carried interest is per se income from an asset-administering activity. According to the court, the attribution to self-employed income pursuant to § 18 (1) no. 4 EStG is merely a legal fiction that does only apply to domestic German taw law but not in the context of tax treaty law. This is because when the Treaty refers to "business profits of an enterprise ", as in Art. 7 (1) Treaty, it obviously means income from an activity that is "entrepreneurial" or “commercial” in nature. The Tax Court of Schleswig-Holstein referred to the case law of the BFH on the comparable case of commercial imprinting (gewerbliche Prägung) pursuant to § 15 (3) no. 2 EStG. This rules also contains a legal fiction that is irrelevant under tax treaty law (see BFH, judgement of 28 April 2010, I R 81/09, BStBl. II 2014, p. 754).

Whether the income constitutes other income within the meaning of Art. 21 (1) of the Treaty or capital gains within the terms of Art.13 (5) of the Treaty was left open by the Tax Court of Schleswig-Holstein for lack of relevance to the judgement, as Germany has the right to tax both types of income.

Given the fundamental importance of the legal question pertaining to the case, the Tax Court of Schleswig-Holstein authorised the appeal (§ 115 (1), (2) Tax Court Code).

V Practical implications

The judgement of the Tax Court of Schleswig-Holstein is the first decision on the important question of how carried interest is taxed in cross-border situations. The judgement is consistent with the already existing case law of the BFH. It is important to note that the judgement is generally only relevant for asset-administrating partnership funds (this also includes partnership funds, which are only commercially imprinted (gewerblich geprägt). Fund managers of such funds based in Germany should have their carry interests analysed for a potential double taxation. The judgement has a positive impact for fund managers of German asset-administrating partnership funds, which are domiciled abroad. This is because Germany should generally have no right to tax carried interest if the fund realises capital gains or interest (not profit-related and not secured with German real estate) based on the judgement of the Tax Court of Schleswig-Holstein.

In the case of originally commercial partnership funds, the country in which the fund is managed should generally have the right of taxation (possibly pro rata if the fund is managed in several countries). This may require coordination with the foreign tax authorities in order to avoid double taxation.

Well

informed

Subscribe to our newsletter now to stay up to date on the latest developments.

Subscribe now