Tightened Obligations to Submit Transfer Pricing Documentation to German Tax Authorities

The DAC 7 Implementation Act has resulted in significant changes in the area of the reasons for submitting transfer pricing documentation pursuant to Section 90 (3) Fiscal Code of Germany (“FC”; Abgabenordnung) as well as the submission deadlines. These changes affect financial years that are already in progress, although the new Section 90 (4) FC is in principle only applicable to taxes arising after December 31, 2024.

Old Legal Situation

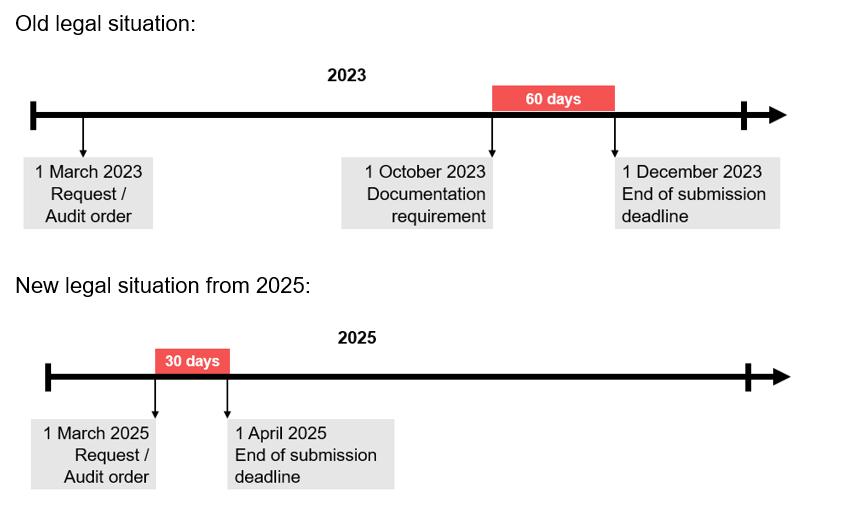

Previously, according to Section 90 (3) sentence 5 FC (old version), the transfer pricing documentation - in the form of the "master file" and the "local file" - generally only had to be submitted for the purpose of a tax audit and even then only upon request within 60 days. Normatively, the discretion of the tax authority with regard to the request for submission was largely limited to submission within the scope of the tax audit by using the term "shall". Like optional provisions, mandatory provisions give the tax authorities discretionary powers. However, the "shall" provision limits this considerably. Thus, the tax authority could only deviate from the regulated case - the submission within the scope of a tax audit - within the scope of its discretion in atypical cases.

New Legal Situation

In contrast, the new Section 90 (4) sentence 1 FC now formulates, using "may at any time", that submission may also be requested in other cases - for example, in the context of the tax assessment. The change of the previous legal situation to an optional provision means that the request for submission within the scope of the tax audit no longer has to be the rule. Instead, the tax authority has a much broader discretion, which is further emphasised by the use of "at any time".

In addition, the tax auditor no longer has to request the documentation anyway due to the new regulation. This is because the obligation to submit the documentation pursuant to Section 90 (4) sentence 2 FC (new version) is already triggered by the announcement of the tax audit order.

Regardless of the reason for the obligation to submit the records - whether as a result of a request or an audit order - the records must be submitted within a period of 30 days. This is a considerable shortening of the previous deadline.

These tightening is by no means a problem only for financial years from January 1, 2025. Because the new regulations also apply to old cases if a tax audit order is issued for these financial years after December 31, 2024.

The aggravation becomes particularly clear when looking at a timeline:

Conclusion

The German legislator has tightened the obligation to submit transfer pricing documentation in terms of content and time. It can be assumed that the transfer pricing documentation will not only be requested during the tax audit, as has been the case so far. Instead, it must be expected that such a request can already be made during the tax assessment. Against the background that there is only a deadline of 30 days for the submission of the records, a preparation parallel to the tax return is recommended.

For permanently tax audited companies - for which the last audit period was 2018 to 2020 - another problem arises with regard to the subsequent audit period 2021 to 2023. This is because the tax return for the last relevant business year 2023 will probably not be filed until 2025. Therefore, Section 90 (4) FC (new version) already applies to the tax audit order for the period 2021 to 2023. As a result, the transfer pricing documentation for the years 2021 to 2023 must already be submitted on the basis of the tax audit order - without any further request by the tax authority - within 30 days of notification of the tax audit order.

Since the preparation effort for the transfer pricing documentation is very high, the transfer pricing documentation should already be prepared now - parallel to the preparation of the tax returns.

Well

informed

Subscribe to our newsletter now to stay up to date on the latest developments.

Subscribe now