Beneficial owner & transparency register: The new EU Anti-Money Laundering Regulation

In July 2021, the European Commission introduced a package of legislative proposals aimed at combating money laundering. These proposals signalled a significant expansion of transparency obligations related to Know Your Customer processes (KYC-processes) and national transparency registers (see our article from 26 July 2021). Since, an agreement on an EU anti-money laundering package has been reached. This new EU anti-money laundering package includes a series of measures by the EU legislature to harmonise anti-money laundering and counter-terrorism financing laws across all EU Member States. The core of the package is the Regulation on the Prevention of the Use of the Financial System for the Purposes of Money Laundering and Terrorism Financing (the “AMLR”). This regulation is set to come into force in mid-2027 and will then become directly applicable law in all Member States. Unlike the current legal framework, which is based on directives (notably the 4th and 5th Anti-Money Laundering Directives) that had to be transposed into national law, the AMLR will leave no room for national implementation discretion (e.g. regarding the determination of beneficial owners in indirect ownership structures).

The AMLR will bring with it numerous changes. These relate primarily to the “beneficial owner”. Based on our initial evaluation of the AMLR, we will summarise the most significant changes in the determination of the beneficial owner below. Our explanations are intended more as a “teaser” for the upcoming changes due to the AMLR, rather than a conclusive presentation of them. This is especially true since there are still uncertainties regarding the interpretation of the AMLR, and additional interpretation guidelines have been announced.

Expansion of the information on the beneficial owner

Article 62 of the AMLR expands the information on the beneficial owner that must be provided as part of KYC processes and reported to the national transparency registers (which will likely be referred to as “central registers” under the AMLR). Upon the AMLR’s entry into force, the following information on the beneficial owner must be provided, with the words in bold-italic font illustrating the main changes compared to the current legal situation.

- Personal details: All names and surnames, place of birth, date of birth, residential address, country of residence, nationality or nationalities, number of an identity document and, where it exists, personal identification number

- Nature and extent of the beneficial interest and date as of which the beneficial interest is held

- Information on the legal entity subject to transparency obligations: legal form, company name, address, names of legal representatives, registration number, tax identification number and legal entity identifier

- Structural information: Description of the ownership and control structure

Lowering of the threshold value

The relevant threshold for qualifying as a beneficial owner in both direct and indirect shareholder structures, due to an ownership interest, is set at a minimum of 25% according to Article 52(1), sentence 1 of the AMLR. Under the current German law, this threshold must be more than 25% of the shares, voting rights, or other ownership interests in the legal entity subject to transparency obligations.

Determining indirect beneficial ownership by calculating the ownership interests through various layers of shareholder structures

The methodology for determining the extent of beneficial ownership through ownership interests is to be standardised across all Member States in the future. So far, the provisions of the Anti-Money Laundering Directives have been interpreted and implemented differently by each Member State. According to the currently prevailing practice in Germany, determining the beneficial owner in indirect shareholder structures requires that controlling influence or control (as defined by the German Anti-Money Laundering Act, AMLA (Geldwäschegesetz, GwG), which generally requires an ownership interest or voting rights exceeding 50%) can be exercised over all intermediary entities through which the beneficial owner holds an interest in the legal entity subject to transparency obligations (“Intermediary Entity/-ies”). The last Intermediary Entity through which the beneficial owner holds an interest in the entity subject to transparency obligations must itself hold more than 25% of the shares or voting rights in the legal entity subject to transparency obligations.

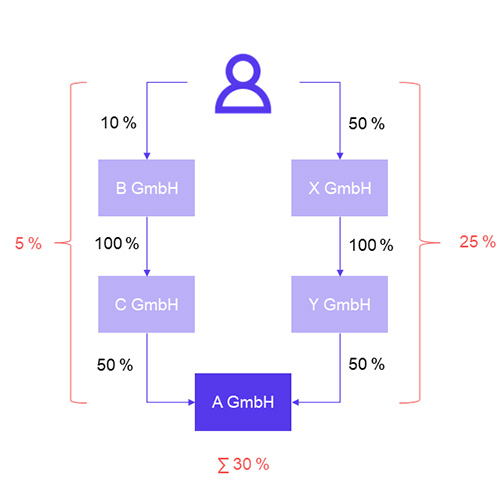

Article 52(1), sentence 2 of the AMLR now adopts an approach already known from other jurisdictions. To determine ownership interests in indirect shareholder structures, the shares, voting rights, or other ownership interests in Intermediary Entities are multiplied along the ownership chain up to the natural person. If a natural person holds shares, voting rights, or other ownership interests in several Intermediary Entities in parallel, the multiplication results of the various chains are added together. Put simply, the aim is to multiply vertically and add horizontally. For example (click here or on the image for an enlarged version):

In the ownership structure diagram above, the natural person qualifies as the beneficial owner of A GmbH, which is subject to transparency obligations, due to his/her notional interest in the capital of A GmbH amounting to 30%. Through the chain of B GmbH and C GmbH, the natural person indirectly holds 5% of the shares in the capital of A GmbH (10% x 100% x 50%).Through the chain of X GmbH and Y GmbH, the natural person indirectly holds 25% of the shares in the capital of A GmbH (50% x 100% x 50%). Ultimately, the natural person thus holds 30% of the capital in A GmbH (5% + 25%). Additionally, the natural person also qualifies as the beneficial owner of X GmbH (due to a 50% capital interest) and Y GmbH (also due to a 50% capital interest, indirectly 50% x 100%).

Beneficial owner of a foundation

According to Article 57(1) of the AMLR, the beneficial owners of a foundation are always cumulatively the following persons: (i) the founders, (ii) the members of the management body in its management function, (iii) the members of the management body in its supervisory function (we currently interpret this to mean that, in addition to the members of the foundation’s board, the members of the foundation’s council are also generally considered beneficial owners of the foundation), (iv) the beneficiaries, and (v) any other natural person who directly or indirectly controls the foundation.

This not only dilutes the desire for increased transparency, as individuals who, according to current practice, would have to be reported as sole beneficial owners will be able to hide behind a multitude of additional beneficial owners that have to be reported as beneficial owners, but also significantly increases the administrative burden for legal entities subject to transparency obligations, as every change in the management and/or supervisory body of a foundation must be reflected in the national transparency register.

“Combination approach” for companies held by foundations

Significant changes for determining the beneficial owner of a company subject to transparency obligations also arise when it is (indirectly) held by a foundation.

Under the currently prevailing practice in Germany, the beneficial owner of a company subject to transparency obligations, which is held to a sufficient extent (more than 25% of the capital or voting rights) by a foundation, is only a natural person who can exercise controlling influence or control over the foundation. In contrast, Article 55 of the AMLR now provides for a “combination approach”. Accordingly, all beneficial owners of the foundation are automatically deemed to be beneficial owners of the company subject to transparency obligations if the foundation holds a significant ownership interest (25% or more of the capital or voting rights). This approach likewise is already known from other jurisdictions and is likely to simplify the identification of the beneficial owner(s). Nevertheless, it will multiply the number of beneficial owners.

Outlook

The AMLR establishes a uniform framework across the EU for determining the beneficial owner. This is expected to provide certain long-term simplifications, particularly for more complex, indirect, and cross-border shareholder structures. At first glance, however, the circle of beneficial owners appears to be significantly expanded. This is evident, for example, from the reduction of the threshold to 25% and the inclusion of additional persons that have to be reported as beneficial owners in connection with foundations.

Companies subject to transparency requirements will therefore experience a considerable burden in implementing the AMLR, as all previous determinations of the beneficial owner of entities subject to transparency obligations, which were conducted under the German Anti-Money Laundering Act, will have to be reviewed in accordance with the AMLR. There are also still numerous ambiguities, and the European Commission has already announced additional guidelines to clarify these issues. It is hoped that the Commission will follow a pragmatic approach.

If you have any questions regarding the AMLR or the determination of beneficial owners and transparency register obligations under current law, please feel free to contact us. We continuously monitor developments in anti-money laundering law and transparency register.

Well

informed

Subscribe to our newsletter now to stay up to date on the latest developments.

Subscribe now