Rebates and bonuses back on the agenda of the competition authorities

Rebates or discounts, bonuses and other sales promotion measures (hereinafter "rebates") are common practice in distribution systems and as such are generally legitimate measures for increasing sales. At the same time, the rules of competition law must always be considered when designing rebates programs.

Sales promotions have in common that the provider or supplier voluntarily offers the customer additional benefits that are linked to the fulfilment of certain conditions. There are sales-related rebates such as volume rebates (e.g. simple volume rebates, target rebates, loyalty or exclusive rebates) and non-sales-related rebates that reward certain other services provided by the customer (e.g. service and function rebates, cash rebates, availability rebates).

In practice, the design of rebate programs is very diverse. From a competition law perspective, the prohibition to abuse a dominant position must be observed (A.) as well as the cartel prohibition which also sets limits on the design of rebate programs (B.).

A. Abuse of a dominant position power in respect to rebate programs

An undertaking in a dominant position has a special responsibility not to allow its conduct to impair genuine undistorted competition on the common market. They must therefore also ensure that the implementation of rebate programs do not amount to an abuse of the companies’ dominance.

Who is the norm addressee?

The addressees of the European prohibition to abuse a dominant position are dominant companies. Dominance has been defined under European law as a position of economic strength enjoyed by an undertaking, which enables it to prevent effective competition being maintained on a relevant market, by affording it the power to behave to an appreciable extent independently of its competitors, its customers and ultimately of consumers.

The German prohibition to abuse a dominant is wider in scope and is also applicable to companies with relative market power. Relative market power can be assumed if other companies are dependent on a company as suppliers or buyers of a certain type of goods in such a way that there are no sufficient and reasonable opportunities to switch to third parties.

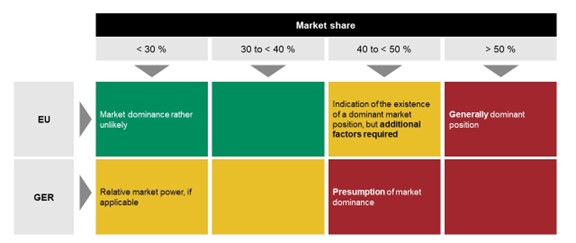

There are no rigid limits either for a dominant market position or for relative market power. It is necessary to consider the individual case. However, the thresholds in the following overview can serve as a reference point:

Click on the image or here to enlarge it

When may rebates be abusive?

Abuses can often be qualified as either exclusionary or exploitative. They are qualified as exclusionary where a company seeks to use its market power to exclude its rivals to restrict competition. They qualify as exploitative where a company uses its market power to extract rents from customers and consumers. Regarding rebates both categories can be of relevance. In practice, however, abusive foreclosure of competitors is more relevant. In addition, rebates must not discriminate customers.

Abusive foreclosure of competitors

Rebates sometimes cross a line of vigorous competition on the merits and unfairly hinder the (dominant) supplier's competitors. This can in particular be the case if they lead to a de facto exclusive relationship between the (dominant) supplier and its customers. The supplier's rebate in these cases have a loyalty enhancing effect on the customer that is capable of excluding the supplier's competitors as an alternative source of supply for the customer.

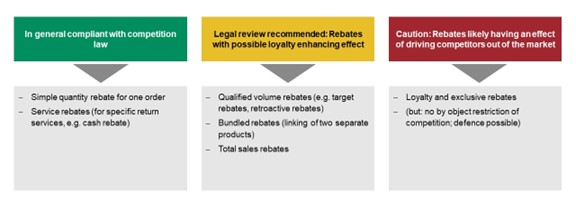

In view of the large number of different options to design rebate programs, the following "traffic light system" can serve as a rough guide as to whether a planned rebate could potentially have a critical loyalty enhancing effect:

Click on the image or here to enlarge it

A case-by-case examination is necessary to establish whether a rebate qualifies as (vigorous) competition on the merits or as abusive conduct. This is particular important for the rebates in the “red zone” shown above. To draw the line, it may be appropriate to work with an "as-efficient competitor test” (AEC test). Though the relevance of the AEC test is debated, it may help to answer the question whether the dominant supplier's rebate program is likely to foreclose a hypothetical competitor that is as efficient as the dominant undertaking. In order to determine this, the European Commission will examine economic data relating to cost and sales prices, and in particular whether the dominant undertaking is engaging in below-cost pricing.

Discriminating rebates

Not every unequal treatment of customers is abusive – it must be based on arbitrariness or aim at objectives in conflict with competition on the merits. This means that a mere price difference is in general not sufficient to assume discrimination in violation of competition law.

Cases in which there is a risk of discriminating conduct include: excessive rebate spreads (e.g. progressive increase of rebate levels along turnover / purchase volume) or customer-specific rebates (customer A receives 2%, customer B receives 7% for the same volumes). Another example is discrimination resulting from the fidelity rebates, where customers in similar circumstances receive different fidelity rebates depending on whether they agree to exclusive sourcing or reserve their freedom to choose their suppliers.

The discriminatory nature needs to be assessed on a case-by-case basis. For example, with regard to whether there are objective and appropriate reasons for the unequal treatment of customers.

B. Cartel prohibition and rebates

Rebate programs must also not violate the cartel prohibition. In general, according to the prohibition of cartels all agreements between undertakings, decisions by associations of undertakings and concerted practices which have as their object or effect the prevention, restriction or distortion of competition within the internal market shall be prohibited, unless there are exceptional circumstances which may make the agreements, decisions or practices permissible.

Rebates create incentives for certain conduct – typically they aim at selling more products. However, occasionally rebate programs also amount to (indirect) restrictions of competition. In principle, vertical agreements between suppliers and customers are exempted from the prohibition of cartels within the scope of the Vertical Block Exemption Regulation (or in the automotive sector, for example, under the additional requirements of the Motor Vehicle Block Exemption Regulation). However, this does not apply to so-called hardcore restrictions. Such restrictions may exist if the incentives associated with the rebates are designed to restrict the customer’s ability to

- set prices completely free,

- actively or passively supply certain customer groups

- use the internet or offline retail,

- actively or passively sell into certain areas.

C. Conclusion and outlook

When designing rebate programs, the previously outlined limits should be observed at any time. Competition authorities are actively scrutinizing rebate programs. In November 2023, for example, the German Federal Cartel Office announced that it would investigate in more detail whether Coca-Cola had structured its conditions and rebates vis-à-vis food retailers in compliance with competition law (German Federal Cartel Office press release).

The prohibition to abuse a dominant position is highly relevant here: if a supplier is dominant or has relative market power, the supplier must take particular care to ensure that its rebates are not abusive, meaning they (i) drive competitors out of the markets and / or (ii) discriminate others in an anti-competitive way.

Irrespective of whether there is an abuse of market power, the rebate may infringe the cartel prohibition. It must be carefully examined whether the incentives associated with the rebate could, for example, have an anticompetitive impact on the pricing of c

ustomers or their selection and supply of customers.

More guidance regarding rebates may be provided by European Commission in its new guidelines on the application of Art. 102 TFEU to cases of exclusionary conduct. At present, the publication of a first draft is planned for summer 2024. In any case, companies are well-advised to continuously monitor the competition law compliance of their rebate programs.